| Рубрикатор |  |

|

| Все новости |  |

World News |  |

|

WiMAX Poised for Portable Broadband Success

| 13 ноября 2009 |

Bolstered by an improving economy and a more suitable marketing plan, global WiMAX subscriptions are expected to grow from 3.9 million today to 92.3 million in 2015.

What happens when you take a strong wireless technology like WiMAX, introduce it with great fanfare and then slam it with a poor economy, slow spectrum licensing and incorrect positioning in the marketplace? Just exactly what happened to WiMAX worldwide over the past year or so.

Previously, Yankee Group forecast that in 2008, global WiMAX subscriptions would hit 3.8 million. In reality, that number won’t be reached until year-end 2009, primarily because WiMAX has been hit with a veritable tsunami of constraints. In addition to a deep, worldwide economic recession and the collapse of the credit markets, WiMAX last year faced slower-than-expected spectrum licensing, especially in areas with huge subscriber potential like India and Indonesia. And as if the economic crisis wasn’t enough to dry up investment dollars, WiMAX also saw a crisis in investor confidence due to its mismatched positioning against 3G and advanced 3G technologies like LTE, HSPA and HSPA+.

What’s Weighing WiMAX Down?

Flawed market positioning is the biggest gating factor for WiMAX, as providers and regulators continue to place WiMAX in the mobile broadband space versus the portable broadband market. Yankee Group defines “portable broadband” as a service that is available for stationary or pedestrian use within limited network coverage areas. “Mobile broadband” services, by contrast, are available over wide coverage areas and support continuous connectivity at vehicular speeds. For the most part, WiMAX and portable broadband are best suited to unserved and underserved markets, whereas 3G and advanced 3G technologies tend to flourish in the mobile broadband arena, where legacy technologies abound.

But when WiMAX first hit the scene in 2004, its primary aim was to disrupt the mobile broadband market, which had a less-than-stellar track record, especially in terms of price, performance and reliability. Since then, however, the mobile broadband industry has pulled its act together and accelerated the development of 3G, HSPA, HSPA+ and LTE. Now, with its 3G competitors in more of a position of strength technology-wise, WiMAX has less of a story to tell-and less of a compelling business opportunity-in the mobile broadband space.

The fact is WiMAX isn’t especially suited to mobile broadband. Its high-performance radio technology and end-to-end all-IP architecture does, however, shine in green-field fixed and portable broadband applications-a market it is just now beginning to address in earnest. While we assume the mobile broadband market will be dominated by technologies like HSPA, HSPA+ and LTE, the portable broadband market-an area of rapid growth especially in emerging EMEA markets like Central and Eastern Europe and Africa-is WiMAX’s for the taking.

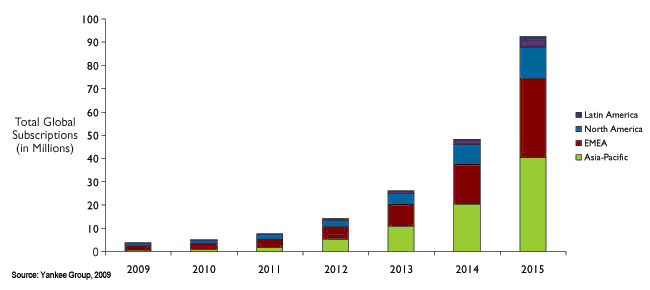

Over the next few years, as the gating factors begin to ease, Yankee Group believes WiMAX is poised to take off. In fact, we forecast that WiMAX subscriptions will grow from 3.9 million today to 92.3 million in 2015, a CAGR of 69 percent (see Exhibit 1).

Exhibit 1: Global Subscription Forecast for Mobile WiMAX Technology

Source: Yankee Group, 2009

Some Like It Mobile

While the lion’s share of WiMAX’s predicted increases will happen in the portable broadband segment, there are notable exceptions to the rule. For example, service providers in the U.S. (in addition to Japan and Korea) are taking a relatively aggressive stance targeting WiMAX toward mobile applications.

In North America, WiMAX activity is dominated by Clearwire, which aspires to deploy a nationwide WiMAX network in the U.S. in the 2.6 GHz frequency band and provide 4G services to its strategic partners, including Sprint and Comcast. Clearwire is in the process of upgrading from a proprietary technology to mobile WiMAX (802.16e), and to date, it offers commercialized mobile WiMAX service in Atlanta, Baltimore, Las Vegas and Portland, Ore., with aggressive plans to launch additional markets through 2009 and 2010. Combine Clearwire with upstarts DigitalBridge Communications and Xanadoo, and the North American market is well-served by WiMAX players.

Another impetus for WiMAX growth in the U.S. market is the American Recovery and Reinvestment Act of 2009, which earmarks $7.2 billion to broadband-related projects. With these factors in mind, Yankee Group projects that WiMAX subscriptions in North America will increase from 1.0 million in 2009 to 13.4 million in 2015, a 53 percent CAGR.

Slow Going in Asia-Pacific

In contrast with North America, the Asia-Pacific region is growing more slowly in terms of WiMAX subscriptions. While it presents tremendous opportunities for WiMAX, particularly in areas like India and Indonesia where there is low broadband penetration, licensing issues are a major stumbling block. For example, our forecast does not account for WiMAX subscriptions in the 2.6 GHz (BWA) band in India because of the continued delay in licensing. Plus, WiMAX has been incorrectly positioned to compete with technologies like HSPA and LTE in the region, resulting in heightened political antics and protracted timelines for spectrum licensing in many markets. In addition, it is unlikely WiMAX will see meaningful adoption in China, where the service providers have embraced TD-SCDMA and LTE TDD.

We do, however, expect that licensing of the 2.6 GHz band-which is most suited to WiMAX-will occur during the forecast period, freeing up WiMAX providers to address this burgeoning market. With that in mind, we project WiMAX subscriptions in Asia-Pacific to increase from 0.5 million to 40.4 million between 2009 and 2015, representing a CAGR of 102 percent over the forecast period.

EMEA Leads the Way

While Asia-Pacific holds the most potential, the region of the globe set for the most dramatic WiMAX growth is EMEA. Our forecast predicts that WiMAX’s strongest adoption will occur in emerging markets in EMEA, particularly in Central and Eastern Europe and in Africa. Investments in Africa are accelerating, particularly with the implementation of several undersea cables and the freeing up of capital markets. We see slow progress for WiMAX in Western Europe, however, because most of the service providers are subscale with networks operating in the 3.5-3.8 GHz bands. We believe that this will remain the case until significant 2.6 GHz frequency bands are auctioned and future acquirers of TDD licenses in Western Europe are required to embrace WiMAX.

Taking these factors into consideration, Yankee Group projects WiMAX subscriptions in EMEA to increase from 2.1 million to 33.9 million between 2009 and 2015, at a CAGR of 59 percent.

WiMAX Languishes in Latin America

Perhaps the best example of market positioning hobbling WiMAX adoption is found in Latin America. Not only is spectrum scarce-particularly in the optimum 2.6 GHz band-but in this 3G-heavy environment, many investors view WiMAX as a “dead” technology and are shying away from making necessary capital investments. In addition, many urban centers across the region already offer speeds in excess of 2 Mbps, leaving WiMAX with few ways to differentiate itself. As a result, WiMAX across Latin America tends to be relegated to rural regions that are of less priority to major service providers.

Even with such constraints, however, Yankee Group sees WiMAX subscriptions in Latin America increasing from 0.3 million to 4.7 million between 2009 and 2015, a CAGR of 59 percent.

Getting There

The global WiMAX market is notoriously difficult to forecast, primarily because it relies on a range of interdependent factors, any one of which can work to stifle demand and service proliferation. To reach our forecast of 92.3 million worldwide WiMAX subscriptions by 2015, several economic, regulatory and technological barriers must be overcome. But we are already seeing signs of progress-particularly in terms of an improved economy and more savvy market positioning.

To gain widespread adoption, WiMAX must gain greater industry support-particularly from regulators and investors. We believe this support depends on WiMAX establishing itself as a compelling portable (as opposed to mobile) broadband solution, particularly in emerging markets. But as long as WiMAX continues to be erroneously pitted against 3G and emerging 3G technologies like HSPA, HSPA+ and LTE in the mobile broadband space, the mobile broadband community will create regulatory and technical roadblocks to stifle the success of WiMAX in the marketplace.

In addition to improved market positioning, regulatory easement in major markets such as India and improved investor sentiment in regions like Latin America are critical for WiMAX to gain meaningful market scale and sustained industry support.

And a little success trumpeting wouldn’t hurt either. In addition to appropriate market positioning for WiMAX, we believe it is contingent upon incumbent WiMAX operators to demonstrate and promote their market successes with the aim of improving confidence among regulators and investors.

WiMAX is a strong wireless technology with a compelling story to tell, especially in the portable broadband arena. Once it overcomes these few market barriers, the technology is indeed poised for global success

Источник: 4G Trends

Оставить свой комментарий:

Комментарии по материалу

Данный материал еще не комментировался.