| Рубрикатор |  |

|

| Все новости |  |

World News |  |

|

The global handset market in the fourth quarter of 2009

| 01 февраля 2010 |

The fourth-quarter numbers for the global handset market are in, and it's time to start parsing the information. Research firms Strategy Analytics and IDC released separate, detailed looks at market share, shipment and growth information for the world's Tier 1 cell phone makers.

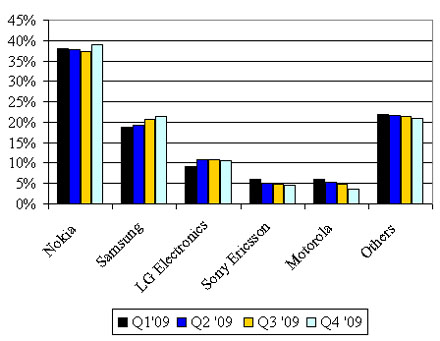

Global market share numbers:

| 2008 | Q1'09 | Q2 '09 | Q3 '09 | Q4 '09 | 2009 | |

| Nokia | 468.4 | 93.2 | 103.2 | 108.5 | 126.9 | 431.8 |

| Samsung | 196.6 | 45.8 | 52.3 | 60.2 | 69.0 | 227.3 |

| LG Electronics | 100.8 | 22.6 | 29.8 | 31.6 | 33.9 | 117.9 |

| Sony Ericsson | 96.6 | 14.5 | 13.8 | 14.1 | 14.6 | 57.0 |

| Motorola | 100.1 | 14.7 | 14.8 | 13.6 | 12.0 | 55.1 |

| Others | 214.8 | 53.7 | 58.9 | 62.2 | 68.0 | 242.8 |

| Total | 1177.3 | 244.5 | 272.8 | 290.2 | 324.4 | 1131.9 |

-

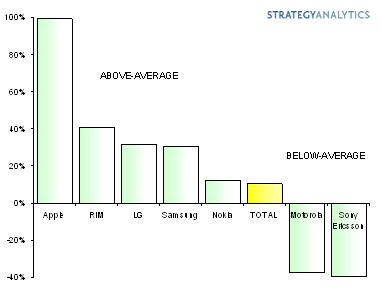

Strategy Analytics: It was a solid performance and Nokia's best set of handset results since the first half of 2008. Shipments, turnover, average selling price and operating margin all exceeded expectations for the quarter. Nokia's handset volumes remained weak in North and South America, and Europe was a little soft, but this was offset by a strong performance in China, Asia and Africa. Nokia has outperformed in smartphones, but longer-term challenges still remain, including below-average share of the high-growth touchscreen market and a tiny presence in the influential U.S. market.

-

IDC: Shipments of 126.9 million in the fourth quarter of 2009 represented the company's highest quarterly total in two years. The higher handset figures were boosted by improved smartphone sales. When its handset shipment performance is measured on an annual basis, however, Nokia shipped fewer devices in 2009 than in each of the last two years.

-

Strategy Analytics: Touchphone models were the key to Samsung's high-end growth in 2009, but we expect the vendor to switch some of its focus to Bada/Android smartphones and the Samsung Apps initiative in 2010.

-

IDC: Samsung capitalized on growing interest in converged mobile devices with its Omnia2 while addressing end-user demand for touchscreen and quick-messaging devices within developed markets. In emerging markets, Samsung's attention to local market tastes and extended distribution channels helped build its presence. Despite its heady growth, the company fell further behind market leader Nokia while distancing itself ahead of LG Electronics.

-

Strategy Analytics: LG's handset operating margin slid to 2 percent in the quarter, down sharply from 9 percent in the previous quarter, as a result of lower ASPs and higher marketing expenses. LG's cost-control mechanisms still have room for improvement. Shipments to North America, South America, Europe, Africa and Asia were healthy, while sales in its home market of South Korea were a little soft.

-

IDC: LG continues to reap success from its popular enV and Cookie products while building its converged mobile device portfolio with the Android-powered GW620 and GW880 and Windows Mobile-powered GW820.

-

Strategy Analytics: Sony Ericsson's market share dipped to well under 5 percent, the lowest level for seven years. The company continues to refocus on value as much as volume. Operating margin, excluding restructuring charges, was minus 2 percent in the quarter, a tangible improvement over the past year's average of minus 12 percent. After slashing thousands of jobs and trimming production capacity across the globe, Sony Ericsson has rightly become a leaner organization and its chances of finally returning to profitability in the next one to two quarters have increased.

-

IDC: Sony Ericsson's sales of 14.6 million handsets represented its highest shipment figure of the year thanks to the introduction of new models such as the Satio and Aino. It also announced the Xperia X10 and Vivaz models that the company says will be released later this year.

-

Strategy Analytics: Motorola and Sony Ericsson have been the highest-profile casualties of the handset recession, each shedding four to five points of global market share over the past 18 months. Both firms developed inadequate 3G handset portfolios, enabling rivals like LG and Apple to seduce operators with more attractive offerings. Motorola is repositioning itself as a smartphone player, centered around the Android OS, and with its global smartphone market share almost doubling quarter-on-quarter to 4 percent in the quarter the initiative has gotten off to a positive start.

-

IDC: In its first quarter, Motorola demonstrated how Android has become a key component of its product portfolio, shipping 2 million units worldwide. Its Droid and Cliq/Dext devices were shipped to more than 20 countries.

Источник: FierceWireless

Заметили неточность или опечатку в тексте? Выделите её мышкой и нажмите: Ctrl + Enter. Спасибо!

Оставить свой комментарий:

Комментарии по материалу

Данный материал еще не комментировался.