| Рубрикатор |  |

|

| Все новости |  |

World News |  |

|

What makes an emerging market for wireless?

| 23 июня 2010 |

Identifying a country that could be classified as a leading emerging market has become increasingly difficult. The broadly accepted classification--subscriber penetration--is being challenged, with some countries that would have been labelled as such a few years ago having achieved astonishing growth rates and which are now recording penetration rates of over 200 per cent.

While these extraordinarily high levels have their own story to tell (more on that later), some of these developing markets are also facing all the challenges normally associated with mature markets in Western Europe or North America: namely, falling ARPUs, pricing wars and high churn rates.Nick Jotischky, a principal analyst with Informa Telecoms & Media, maintains there is no longer an easy answer to defining an emerging market. "The traditional route of recording penetration rates is now too simplistic, with many countries in Africa and Asia Pacific having rates higher than 50 per cent, with only a few having levels lower than this."

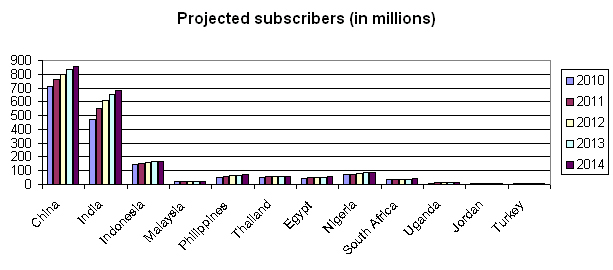

Source: Informa Telecoms & MediaCalculating the marketWhile penetration levels are a factor--for example India is presently below 50 per cent today--Jotischky believes there are a number of ways to evaluate a given market. For example, the number of operators in play can provide insight into the trajectory of a particular market."India is a classic example with between 13 and 14 service providers in operation, while Nigeria has 11 operators," said Jotischky. "What we now believe is that these countries and others with high operator numbers will rapidly track what happened in European markets, and there is the strong likelihood of operator consolidation."Jotischky said the rapid evolution in emerging markets also will force operators to transform and revamp their business models. "They should be looking for incremental revenue from new services such as mobile payments or mobile broadband."Operators could also consider network sharing, whereby carriers can gain ground on network quality and coverage by combining their infrastructure efforts.According to Jotischky, operators in emerging markets will increasingly move toward sharing networks with rivals, and managed services could possibly follow the same route. "Ultimately, the quality of the network is the real differentiator in retaining customers in emerging markets, and some operators have not entered into the widespread price wars and instead promoted network quality as a means to retain their customers."Counting subscribers, counting SIMsFurther clouding the measurement of emerging markets is the breakdown between the number of active subscribers and the number of wireless subscriptions.

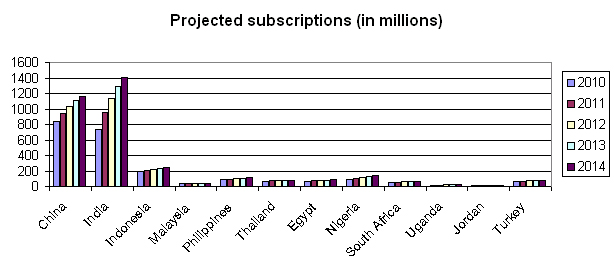

Source: Informa Telecoms & MediaAccording to Alan Carr, a specialist in communications and electronic systems with PA Consulting, high roaming charges in the Middle East are a major factor behind some of the surprisingly high subscription numbers measured in Qatar, the UAE and other countries."There is a growing trend for many people to have separate handsets for business and personal use," said Carr. "They will also have an additional phone or SIM card if they travel to another country due to the increasingly high roaming charges imposed by operators in the Middle East."Carr maintains that the mobile market in the Middle East has shifted rapidly from being classified as emerging towards being a developing or a developed market.Exacerbating the trend toward multiple subscriptions among wireless subscribers are pricing wars sparked by operators struggling to capture or retain market share. Carriers' short-term promotions are provoking consumers to switch rapidly from one service provider to another as they search for the latest cut-price option.This has caused consumers to own numerous SIMs that they will selectively use or discard depending on the most recent and cheapest offer, according to Informa Telecoms & Media's Jotischky."We may see millions of SIMs in supposed use, but this doesn't translate into active subscriber numbers. So whilst some emerging countries may indicate penetration levels of 60 per cent to 70 per cent, where there is intense competition this could be misleading and the real figure is likely to be much lower than this."This unprecedented level of churn is recognised by operators as a real and growing problem. MTN, one of Africa's largest operators, has had some success in lowering churn rates by boosting its loyalty scheme alongside heavyweight promotional advertising.One large operator in Nigeria has launched an SMS-based promotional scheme which encourages users to text a certain number with the promise of financial gain. While this activity has been viewed as bordering on the disreputable by some, it has been reported as being very effective in raising ARPU and retaining customers.Managing this pricing battle is almost a day-to-day activity for these operators, and the success of their tactics is key to their midterm survival. And, further down the road, carriers must deal with the financial and logistical problems of expanding their networks to provide coverage to huge rural areas.

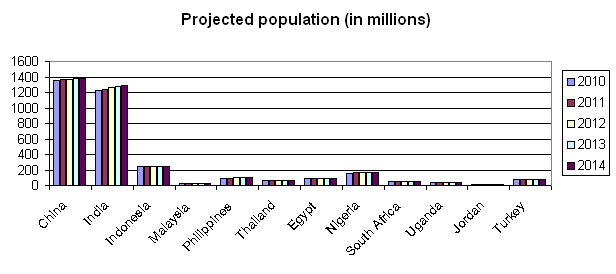

Source: Informa Telecoms & MediaAltogether, these challenges are little different from where so-called developed markets were less than a few years ago.

Источник: FierceWireless:Europe

Заметили неточность или опечатку в тексте? Выделите её мышкой и нажмите: Ctrl + Enter. Спасибо!

Оставить свой комментарий:

Комментарии по материалу

Данный материал еще не комментировался.