| Рубрикатор |  |

|

| Все новости |  |

World News |  |

|

Up to 35% of operators’ subscriber base is at risk in 2011

| 14 января 2011 |

2011 will be a year of market saturation and increased competition for many fixed and mobile operators. According to findings from Analysys Mason’s Connected Consumer survey of 6000 telecoms users, consumers are more willing to change provider than they were a year ago.

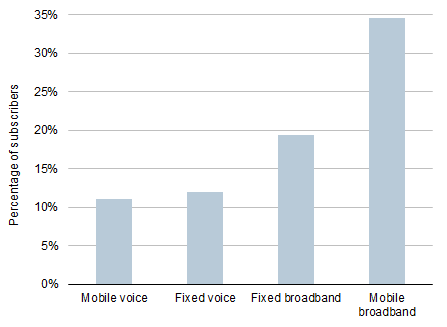

Almost 35% of mobile broadband customers want to leave their service provider within the next six months (see Figure 1). The potential churn numbers for mobile voice, fixed broadband and fixed voice are also a cause for concern.

Figure 1:

Percentage of subscribers that want to change provider, by service

[Source: Analysys Mason's Connected Consumer survey, 2011]

Consumers are now more willing to act upon poor quality of experience

Subscribers’ willingness to act upon poor quality of experience is increasing. Our latest figures indicate that more than 70% of European respondents who were ‘very unsatisfied’ with their fixed broadband experience intend to change service provider within the next six months, compared with less than 50% a year ago.

Fewer people intend to change fixed voice service provider, or drop fixed voice services altogether, during the next year. This is partly because many consumers that intended to drop their fixed services have done so already. Furthermore, PSTN is becoming a secondary fixed service – satisfaction with fixed broadband services is increasingly becoming the primary driver for fixed churn.

Of those respondents who were sure about their plans for mobile broadband, 44% of UK users intend to switch service provider in the next six months, compared with just 26% of users in Germany. The high potential churn rate for mobile broadband is primarily a result of dissatisfaction with the quality of experience. Customers may have anticipated a better service than they are receiving.

The good news for mobile operators is that only about 11% of mobile voice subscribers intend to change provider. The propensity to churn is closely correlated to age: 25–34 year-olds are the most keen to find a better deal, even though they are among the demographic groups with the highest levels of disposable income.

Content and applications are influencing mobile phone users’ buying decisions. Up to 25% of users of high-end smartphones (that is, users who have access to these sophisticated services) would switch to a new network if they could not gain access to specific mobile content and applications with their current provider. If MNOs block access to services or applications (for example, by not offering certain handsets) they risk losing subscribers – particularly high-end subscribers.

The mood of the market presents both an opportunity and a threat

Consumers’ plans to change provider present both the threat of losing subscribers and the opportunity to lure customers away from competitors. Operators need to recognise that the service aspects that attract new customers are subtly different from those that retain established subscribers. Price, and a sense of value for money, are a common priority across current and potential customers. Competing on price alone is not a strong long-term strategy, but can increase custom if used tactically. In order to maximise customer retention, service providers need to prioritise customer care. This is the experience factor that has the highest correlation to overall customer satisfaction levels, but improving it can be costly.

Martin Scott, Senior Analyst

Оставить свой комментарий:

Комментарии по материалу

Данный материал еще не комментировался.