| Рубрикатор |  |

|

| Все новости |  |

World News |  |

|

Analyzing the world's 10 biggest handset makers in Q4

| 03 марта 2011 |

The numbers are in, and it's time to make sense of the data. ABI's Michael Morgan checks out the world's 10 largest branded cell phone makers in the fourth quarter of 2010, providing sales data as well as insight into their strategy and competitive position in the market.

Though most research firms only list the market's top five handset makers, ABI lists the full top 10 (and the firm is providing shipment numbers for all of the vendors listed).

A few notes: ABI's numbers represent "sell in," or phone shipments into the retail channel, rather than "sell out," or sales to consumers. Further, ABI's ranking only counts phones that carry the manufacturer's brand. Therefore, phones that bandy a carrier's logo without a hint of which company actually built the device are not counted.

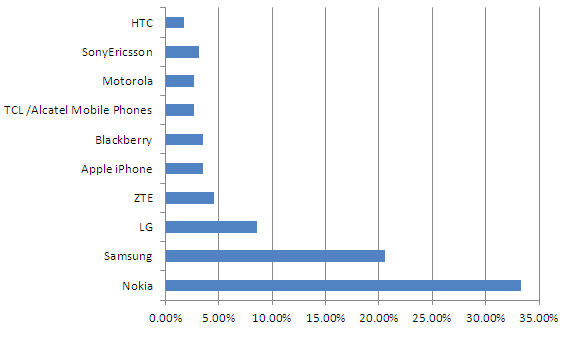

Vendor

market share, Q42010

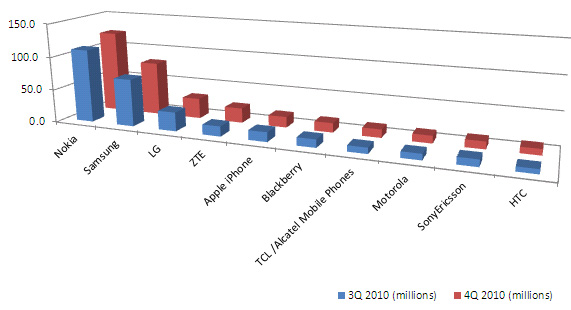

Handset shipments by vendor, 3Q2010 to 4Q2010

Analysis from ABI's Michael Morgan

|

Nokia |

Nokia handset shipments sequentially increased 12% Q4 while the overall market grew 12.7% sequentially. As a result Nokia's market share fell to 31.7% in the fourth quarter. The world's largest handset OEM has been losing market share in emerging markets where the low cost handsets that make up 77% of its shipments are facing competition from white label OEMs and top ten companies such as ZTE and TCL. ABI Research believes that the trend of market share loss will continue to accelerate as the handset giant absorbs yet another 're-org.' Nokia has tied its future smartphone fate to Microsoft's mobile OS and ecosystem which has alienated most of Nokia's staunch developer support. ABI Research believes that Chinese manufacturers will in turn pick the bones of Nokia's feature phone and low cost business, leaving the handset giant to ponder where it all went wrong. |

|

Samsung |

As companies get larger, it becomes increasingly difficult to deliver organic growth that meets or exceeds the industry average. Samsung has managed to exceed the industry average growth by delivering competitively priced handsets with the design features of more expensive handsets. In the smartphone realm, Samsung has shown great success with its Android-based Galaxy series and its homegrown Bada OS. Showing success in nearly all of its key device categories, with broad carrier relationships and vertical integration of mobile chips and AMOLED screens, Samsung has become the company that Nokia wishes it was. ABI Research believes that Samsung's execution can deliver it to the No. 1 position in as little as two years. |

|

LG |

LG's shipments rose 7.7% in Q4 but did not keep pace with overall market growth. LG has been struggling to move from the feature phone world to a profitable smartphone venture on the back of Android and eventually a strong push for 3D screens. While LG follows a similar Samsung ethos of high-tech handset at competitive prices, it may be time for LG to stop following its bigger brother and find a path that works for LG's smaller scale operation. |

|

ZTE |

ZTE has made a name for itself with low-cost handsets in emerging/developing markets such as India, China, LATAM and Africa. For ZTE, the shipment of CDMA and TD-SCDMA handsets almost doubled compared to 3Q10, that’s the main engine for total shipment growth. Leveraging manufacturing locations in 50 countries, ZTE is able to deliver low-cost handsets either under the ZTE brand or white-label devices for carrier branded handsets for large operators such as Vodafone. ZTEs focus on emerging markets has served it well as Nokia bleeds share in these segments which are predicted to deliver the greatest number of new wireless customers in the coming years. As China rises, ZTE is positioned to benefit from Nokia's failings and the growth of China's homegrown 3G networks. |

|

Apple iPhone |

With only 3.5% of total handset shipments in 2010 Apple has captured over 50% of the handset industries profit. By refusing to buy market share with lower cost devices, Apple has made itself the No. 1 aspirational brand in mobile phones. Despite Apple's continued annual meteoric rise, the iPhone barely kept pace with industry growth in Q4. ABI Research believes that this does not signify a top to Apple's handset growth, but merely a signal that we will now see 'phase II' of Apple's handset strategy; whereby a whole new consumer segment is given the privilege of joining the Apple cult, through a new class of device. |

|

BlackBerry |

Many have noted that RIM smartphones are falling behind the competition and that the iconic business device has drastically lost market share in its home market of North America. What many do not see is that 37% of all RIM handsets ever sold occurred in 2010 while RIM was losing North American market share to Android and Apple. RIM's dirty little secret has been increasing success in international markets where its BlackBerry Messenger service has become an all around hit. In addtition to success with international consumers, the smartphone industry has yet to bring to the table a serious competitor to RIM's enterprise server capabilities. ABI Research's peak into RIM's kitchen has found many compelling features, capabilities and services that are sure to keep RIM devices relevant for a while to come. |

|

TCL /Alcatel Mobile Phones |

TCL is a well-known electronics brand in China that formed a joint venture with Alcatel of France to leverage new markets and carrier relationships. For TCL, the strong growth was led by a 105% jump in overseas sales of entry- to mid-level devices in EMEA. The Alcatel / TCL device portfolio is a mix of low-end candy bar devices and colorful clamshell devices with basic media capabilities. Most TCL handsets are designed to meet the universal needs of all regions served by Alcatel and TCL, allowing for greater production volume per device model. ABI Research believes TCL has taken advantage of the growing power vacuum left from Nokia's decline in the low-cost segment. |

|

Motorola |

Beyond continued growth in smartphone shipments, Motorola's most important Q4 achievement was to deliver profitability. Having split the company in two, with Motorola Mobility taking ownership of the handset business, Motorola's transformational efforts are finally yielding the intended benefits. After years of market share loss, Motorola is no longer the global powerhouse it used to be, as such ABI Research believes it is imperative that Motorola continue to execute flawlessly with its Android portfolio and use this momentum to re-establish carrier relationships in new regions beyond North America. |

|

Sony Ericsson |

Sony Ericsson has found itself in a similar position to Motorola (both in terms of strategy and top ten rankings). In the midst of a turnaround based on the back of Android, Sony Ericsson was able to eke out a profit in Q4. As Sony Ericsson continues to get its 'sea legs' in the rapidly changing smartphone market, the handset maker has stumbled upon a potential winner in the soon to be released gaming smartphone the Xperia Play. With strong ties to Sony PlayStation game developers, an exclusive Verizon Wireless relationship, the potential to wrap itself in Sony's content ecosystem and the Android application store, the Play could be the breakthrough device Sony Ericsson needs. |

|

HTC |

The fastest growing smartphone vendor HTC, has again earned the right to be listed among the top 10 handset vendors. With 2% of the overall handset market and 10% of the smartphone market in Q4, HTC continues to rely on high-tech design layered over the Android operating system. Like Samsung and LG, HTC offered some Windows Phone 7 devices in Q4 with little success. Considering the recent Nokia-Microsoft alliance, it can be expected that HTC will seek other inroads to the lower end of the smartphone market segment. ABI Research believes that HTC's 100%-plus 2011 growth guidance is achievable, as HTC begins to prove its capabilities with 4G (LTE) devices. |

The raw data

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Источник: FierceWireless

Читайте также:

Сеул создаст крупнейший центр по выпуску чипов

В App Store обнаружены мошеннические инвестиционные приложения

Роскомнадзор закупает смартфоны для исследования их уязвимостей и скрытых угроз

Объем российского рынка смартфонов уменьшился и в штуках, и в в деньгах

Apple оплатила антимонопольный штраф в размере 906 млн рублей

Оставить свой комментарий:

Комментарии по материалу

Данный материал еще не комментировался.