| Рубрикатор |  |

|

| Все новости |  |

World News |  |

|

3G will account for 84% of all mobile connections in the MENA

| 21 октября 2011 |

The mobile markets in the Middle East and North Africa (MENA) region are rapidly approaching saturation because lower prices have made mobile services more affordable. In higher-income countries like Saudi Arabia and the United Arab Emirates (UAE), the mobile penetration rate already exceeds 100% of the population, and will surpass 100% in lower-income countries such as Egypt in 2012 and Morocco in 2011, according to the latest forecasts from Analysys Mason’s The Middle East and Africa regional research programme.

Therefore, we expect MNOs to shift their focus from subscriber acquisition to subscriber retention and mobile data services.

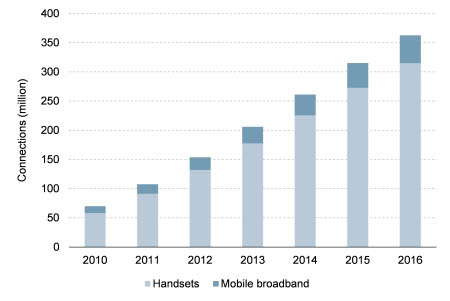

In our forthcoming report, we provide forecasts for six countries: Algeria, Egypt, Israel, Morocco, Saudi Arabia and the UAE. 3G mobile services are available in all these countries (except Algeria), and operators are focusing on increasing network speeds and coverage. Because fixed broadband services are not widely available outside major urban centres, the vast majority of broadband connections are mobile. Furthermore, because of low PC penetration in all but the highest-income countries, most users in MENA access the Internet on their mobile handsets – particularly in lower-income countries. We forecast that the number of 3G connections will grow from 70 million in 2010 to 363 million in 2016, which will represent 84% of all mobile connections (up from 18% in 2010). We expect to see more affordable (sub-USD100) 3G smartphones as volumes increase worldwide in response to demand from developing markets. As a result, handsets will continue to account for the bulk of 3G connections throughout the forecast period (see Figure 1).

Figure 1: 3G connections, the Middle East and North Africa, 2010–2016 [Source: Analysys Mason, 2011]

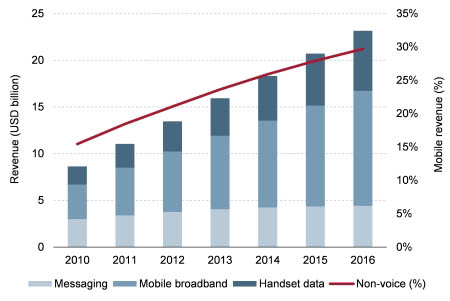

As 3G becomes more widely available, and operators compete more intensively for mobile data subscribers in order to compensate for declining voice revenue, mobile non-voice usage will increase considerably. [Note that although LTE was launched in Saudi Arabia and the UAE in 2011, we do not expect LTE to be a major factor in other MENA countries until 2014 or 2015.] In 2010, non-voice revenue (which includes messaging, handset data and mobile broadband) represented 15% of mobile revenue. We forecast this will grow to 30% by 2016 (see Figure 2). Handset data revenue will grow the most rapidly, at a CAGR of 20% between 2010 and 2016, while mobile broadband revenue will grow nearly as quickly, at a CAGR of 19%. However, messaging revenue will grow more slowly, at a CAGR of 5%, because subscribers will continue to use applications such as Facebook and BlackBerry Messenger, which do not generate messaging revenue for operators.

Figure

2: Non-voice mobile revenue, the Middle East and North Africa, 2010–2016

[Source: Analysys Mason, 2011]

Despite the emphasis on mobile data, mobile voice will continue to account for the majority of revenue in 2016, although its CAGR will be relatively slow at 3%. We expect following factors to continue to exert downward pressure on mobile voice pricing.

New users tend to be price-sensitive.

Competition will continue to cause a dramatic decline in mobile voice revenue per minute (RPM), as will the fact that operators are passing along savings from mobile termination rate reductions.

Users continue to use more than one SIM, which splits the spend across multiple operators.

Consumers have been conditioned to expect promotional offers.

Because prepaid subscribers dominate the market, generating loyalty is a challenge.

The combination of these factors will result in mobile ARPU declining from USD15 in 2010 to USD11 in 2016.

By Roz Roseboro, Principal Analyst at Analysys Mason

Читайте также:

До конца 2023 года МТС отключит сеть 3G 2100 Мгц в пределах ЦКАД

МТС ускорила мобильный интернет после перевода в стандарт LTE базовых станций 3G

Сети 5G mmWave в Европе: перспективы и экономические выгоды

Сети сотовой связи обгоняют абонентские устройства

Analysys Mason и Huawei показали, как цифровая трансформация преобразует операционную деятельность

Оставить свой комментарий:

Комментарии по материалу

Данный материал еще не комментировался.