| Рубрикатор |  |

|

| Все новости |  |

World News |  |

|

Is usage-based pricing inevitable?

| 05 февраля 2010 |

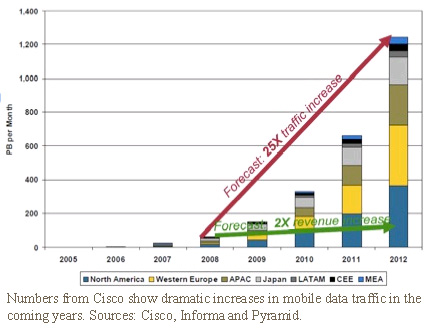

Wireless carriers are facing a conundrum: They have invested billions of dollars into improving network capacity, but only a small number of users are responsible for the majority of the network's total data traffic. And while there has been some discussion about usage-based pricing as a solution, there are a range of roadblocks facing operators that chose to travel down that path.

Metered pricing is a simple-sounding solution that has many complex parts. It's technically possible, but how carriers implement the service will depend on their individual business situations.

"I think that it is inevitable for the industry to move toward this, otherwise the business model is not sustainable," said Rafi Kretchmer product marketing manager for revenue management at billing systems vendor Amdocs. He noted that low-volume data users are essentially subsidizing heavy data customers. "In order to address this conflict, they realize that to not leave money on the table, they must differentiate the pricing."

Others agree. "It's a necessary consequence of rising usage of mobile data," said Alastair Hanlon, director of product management at Convergys, another billing vendor. "As usage grows to a level where you're filling all of the available capacity, you're going to see a need to somehow control that usage. And price is a good way of doing that."

Momentum is growing

The introduction of 3G networks in the United States coincided with the widespread use of flat rates for unlimited data use. Carriers sought to entice users by removing the often-confusing per-megabyte pricing of second-generation networks. Today, most wireless carriers offer unlimited data access for around $30 per month for smartphones or $60 per month for laptops.

(Most carriers also impose a usage cap--typically 5 GB per month--in the fine print in order to prevent network overloading, though Sprint Nextel pointed out that its mobile WiMAX service, branded Sprint 4G, currently does not carry a cap.)

However, due to recent, skyrocketing interest in apps and smartphones, carriers' move to simplify the world of data pricing has turned into a liability, rekindling discussions about metered, usage-based pricing.

And carriers seem to be warming to the idea. In January, Verizon Communications CTO Richard Lynch hinted that when Verizon Wireless launches its LTE network later this year, it will introduce a usage-based pricing model, charging customers by how much bandwidth they use.

"The problem we have today with flat-based usage is that you are trying to encourage customers to be efficient in use and applications, but you are getting some people who are bandwidth hogs using gigabytes a month and they are paying something like megabytes a month," Lynch said in an interview with the Washington Post. "That isn't long-term sustainable. Why should customers using an average amount of bandwidth be subsidizing bandwidth hogs?"

In December, AT&T Mobility President and CEO Ralph de la Vega confirmed at an analyst conference that about 3 percent of AT&T's smartphone users generate about 40 percent of its data traffic. De la Vega said the carrier would consider ways to educate users on their data usage, with the intention of preventing excessive use. However, AT&T has not come out explicitly in favor of usage-based pricing.

"Given the dramatic increase in mobile broadband data usage, there needs to be a long-term model that best balances the finite amount of available frequency, the disparity in usage patterns among customers, and the investment and innovation required to make it all happen," AT&T spokeswoman Jenny Bridges said. "There are many ways to address this explosion in data usage to ensure that everyone is able to share the benefits delivered by mobile broadband. We'll continue to explore the best path forward."

T-Mobile USA declined to comment on its pricing plans.

Technically possible

Convergys' Hanlon said there are no technical reasons carriers cannot move from a flat-rate pricing model to a usage-based one, explaining that carriers have been metering voice for a long time and are currently charging customers when they exceed soft data caps--usually 5 GB per month. One challenge, he said, is migrating carriers' older legacy billing systems to ones that are more flexible.

According to Kretchmer, such upgrades involve installing new software and transferring data models and subscriber information into a new system. Then, carriers must integrate the new system into existing back office systems such as customer management and financial management. Finally, the new system must be linked to the core network, so it is aware of how subscribers are using mobile data.

Installing such a system may take roughly four to six months, depending on how many subscribers a carrier has on its network.

Dynamic subscriber engagement

Aside from installing new billing systems, the real issue is what carriers will do with them. "Integrating business analytics with the billing environment is important in order to be able to segment the subscriber base and then offer the right packages to the right subscribers at the right time," Kretchmer said.

And there are a variety of options available to carriers.

Convergys' Hanlon said tiered pricing--small, medium, large and extra large--based on different data usage thresholds could be one solution. And Kretchmer said carriers could go a step further by dynamically engaging with subscribers via usage notifications. Carriers could then analyze the usage patterns of mobile data subscribers and offer tailored and personalized pricing plans that fit their needs--and charge accordingly.

"I think the issue here with mobile data is that subscribers have less intuition and less gut feeling into their consumption levels when it comes to data," Kretchmer said, adding that, "this is where real-time charging capabilities are so crucial in the sense of the customer experience. Customers are in risk of bill shock."

Declan Lonergan, an analyst at the Yankee Group, said this "dynamic" approach would need to factor in elements including a user's physical location, the level of network congestion and the type of application running. He acknowledged that doing so would likely instigate fierce opposition from net neutrality proponents who do not think carriers should modify the network experience for different use cases.

But he likened it to the airline industry, where travelers pay based on real-time demand and the type of accommodations they want.

Looking at the situation from the carriers' perspective provides some clarity, said Akil Chomoko, product marketing manager for Volubill, which offers charging, control and policy services to telecom and Internet providers. "If I change the way my network manages my subscriber usage, I can increase revenue, keep valued customers and reduce capex spend."

A business decision

When and if carriers decide to implement usage-based pricing is still up for debate. However, most agree it is a necessary evil.

"To go to a usage-based model is conceptually very good. And I can see the need to do it," said Frank Dickson, an analyst at In-Stat. "But you can't do it in a vacuum."

Dickson believes that Verizon may have the wherewithal to launch usage-based pricing when it rolls out LTE--but the carrier will have to remain flexible.

"If there's some resistance from customers on usage-based plans for LTE, Verizon is going to change," he said. "Verizon has got to monetize that spectrum. They've got to."

Joel Espelien, chief business officer at PacketVideo, said it will be very difficult for carriers to explain to subscribers why they should switch from all-you-can-eat plans to usage-based pricing. People have gotten used to flat-rate plans, he said, and don't want to give it up. Indeed, Espelien is deep into the issue: PacketVideo offers technology to more efficiently stream video over wireless networks.

Others are convinced it's simply a matter of properly advertising the new pricing structure to users--though that is no small task. "I won't deny it's a very difficult communication and marketing challenge for the carriers," Hanlon said.

Lonergan agreed that tiered pricing would be a tough sell with users, but described it as "a one-off challenge the industry has to take on." He said the only way it will work is if carriers' marketing departments are tightly aligned with users' usage patterns and preferences. "You've got to have that end-to-end solution," he said. "But it's not rocket science to do that."

Carriers have the tools to make usage-based pricing a reality, and it appears there is enthusiasm for the idea. Ultimately, though, operators will have to decide if usage-based pricing makes sense for them from a business perspective.

"This is more a matter of realizing this is a business challenge here," Kretchmer said. "And something needs to happen."

Источник: FierceWireless

Читайте также:

Опубликован перечень поручений по итогам заседания Совета по стратегическому развитию и нацпроектам

Сингапур готовится к отключению связи 3G

Решения N3COM прошли тестирование на сети LTE ОАО «РЖД»

МТС начинает отключать старые сети 3G

билайн завершил масштабную модернизацию сети в Московской области

Оставить свой комментарий:

Комментарии по материалу

Данный материал еще не комментировался.