| Рубрикатор |  |

|

| Все новости |  |

World News |  |

|

Will Open Roaming Break Down Operator’s Control of Devices?

| 29 апреля 2011 |

Cross-currents between the expanded use of mobile wireless as the most common data interface and alignment of consumer purchasing decisions is pushing for common IP data roaming that is at odds with the ratcheting up of spectrum and capital requirements. The recently announced acquisition of U.S. operator T-Mobile by AT&T threatens to reduce competition among leading operators. The FCC has issued a ruling on data roaming that, combined with prior open access and device rulings and market evolution, is likely to result in further dramatic changes in the way devices and applications are delivered and affect the control of markets and operator revenues.

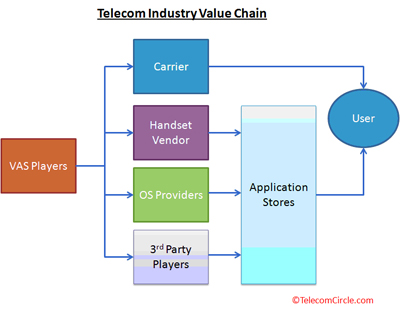

The fast pace of change in devices and the applications and services that run on them has already shifted control away from operators and prior sales channels and toward direct and streamlined value-added chain. Applications and service are fronted by the emergence of app stores. And the applications and stores have broadened to become a major gateway for delivering content and value-added services, detouring revenue from the pre-2007 operator model.

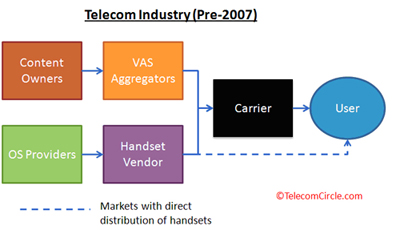

The pre-2007 (pre-iPhone) mobile telecom model funneled content and services through operators, which have held the critical control over subscriber information and billing. The new model creates multiple avenues of delivery from multiple sources with players acting both as silos and in collaboration.

Furthermore, a restructuring in the makeup of what has been considered the new bread-and-butter emerging services including mobile payments, location-based advertising, gaming, and social/business networking and collaboration is taking place. While the opportunity for operators to play a leading role in emerging services still exists, the track record of most operators leads to the expectation that most activity will occur with more fleet-footed open market rivals.

Why Operators are Losing Control

Operators are losing control of device-applications-content revenue streams because they are not delivering the framework environments that funnel their creation and consumption. Operators became lulled into thinking that control of the network transport infrastructure would sustain the revenue model even as the industry broadened to become data centric. To their credit, many have seen the changes coming for several years but then did too little to build the new engines of collaborative development and applications and content sales delivery. The application store itself is a very simple, almost mechanical development and sales chain: applications built using open source tools that meet basic criteria are made available for free or for sale on simple searchable app store portals. The disconnect for operators was "business as usual." Operators familiar with dealing with device suppliers who brought their own OS or open source derivatives and with a limited number of value-added applications and content suppliers did not anticipate the need to create a marketplace and active participation that would motivate the armies of developers that are essential to the new market model. Recent efforts by operators, with a few possible exceptions such as China Mobile, have met with little success thus far.

Operators are attempting to recapture ground lost to Apple and Google through the Wholesale Application Community (WAC), an alliance of mobile operators that wish to provide a streamlined ecosystem for developers to deliver applications into many networks.

- The goals and structure of WAC’s effort appear well charted:

- Develop a Web app using WAC technology

- Submit your app to the WAC distribution platform

- Commercialize your app with the WAC member Application Stores connected to the platform

However, the pace of industry has already sped past the opportunity stage for new entrants. We see little that WAC provides that is of such a pivotal nature that it can intercede into the current ecosystem between application OS environments and users. This may add incremental value but does not change the relationship most developers have already established: building apps for one or two of the leading OSs and, if successful, porting or re-writing to run on additional OSs. WAC may help ease the development process somewhat but, thus far, we surmise that this is too late and too slow to galvanize industry supply chains.

What could steer the supply ecosystem into their direction? Most likely what developers want most: money. Delivering that is a Catch-22 proposition: Apple and Google command the lion’s share of the app store marketplace with Nokia, Microsoft and RIM coming in behind. Developers we have had talks with mention the heavy-handed nature of Apple and the difficulty of standing out from the crowded numbers of applications that are available. If operators can project their marketing muscle to vault a few example applications to the top of the sales numbers boards, other developers will be more likely to flock in their direction. We shall see if WAC is able to deliver on its goals – we have our doubts.

Broadband roaming has the potential to be the additional ingredient that ensures the shift from the operator-dominated device ecosystem to the multi-screen, multi-device, multi-OS plug-and-play IP environment. If users can roam at reasonable cost across data networks, the preference for open, cloud-based applications and content will tend to relegate individual operator’s networks less in control over device choices.

by Robert Syputa, Senior Analyst, Maravedis, Inc.

Источник: 4G Trends

Оставить свой комментарий:

Комментарии по материалу

Данный материал еще не комментировался.