| Рубрикатор |  |

|

| Все новости |  |

World News |  |

|

A Strong Intel Disappoints on Outlook

| 25 января 2008 |

Intel reported record fourth-quarter revenue, but the chip maker’s shares dropped sharply after hours as its earnings and its first-quarter projections disappointed an already jittery Wall Street.

The company reported revenue of $10.71 billion, up 10.5 percent from the quarter a year earlier, but below the midpoint of the company’s guidance and about $100 million short of analysts’ forecasts.

The report comes amid rising investor concern about the impact of a possible slowdown in spending on computers in the first half of the year. For the first quarter, Intel forecast revenue of $9.4 billion to $10 billion, on the low end of analysts’ forecast of $10 billion.

The report comes amid rising investor concern about the impact of a possible slowdown in spending on computers in the first half of the year. For the first quarter, Intel forecast revenue of $9.4 billion to $10 billion, on the low end of analysts’ forecast of $10 billion.

Yet Intel executives said overall demand for computers was strong in the fourth quarter, and instead largely attributed the disappointing revenue to lower prices for a variety of memory known as NAND, used in flash-memory cards.

“You hear the pundits saying that the world is going to go into a trash basket and you worry,” Paul S. OTELLINI, Intel’s chief executive, said in a conference call with analysts. “At this point we don’t see anything on the horizon.” Intel executives said demand for computer products was as expected in the quarter.

Net income was $2.27 billion, a 51 percent rise over the fourth quarter of last year, when Intel’s net income was $1.5 billion. Earnings per share were 38 cents, 2 cents short of analysts’ forecasts, according to Thomson Financial. They were 26 cents in the quarter last year.

Intel is closely watched as an indicator of the strength of the technology industry, and its strong performance in the third quarter bolstered investor confidence in October. But the first quarter is often Intel’s weakest, and investors are increasingly concerned that tendency could be compounded by an overall slowdown.

Two weeks ago, Banc of America Securities and JPMorgan downgraded Intel to a neutral rating on concerns of weakening demand.

“What we’re seeing are the first signs of a slowdown,” said Christopher DANELY, an analyst with JPMorgan. “By the end of earnings season people will be convinced there’s a problem out there.”

Shares of Intel ended regular trading at $22.69, down 39 cents, or 1.7 percent. After the market closed and the earnings report was issued, the shares declined to $19.48, a drop of 14 percent.

“It’s disappointing,” said Cody ACREE, an analyst with Stifel, Nicolaus & Company. “We were holding out hope that there’d be some comfort, but none was forthcoming.”

One bright spot was gross margin, which was 58.1 percent for the fourth quarter, beating the company’s own target, and improving from 52 percent in the third quarter.

For the full year, Intel reported revenue of $38.33 billion, an 8 percent gain over 2006, and net income of $6.98 billion, an increase of 38 percent.

“The fourth quarter capped a very strong 2007 for Intel,” Mr. Otellini said. “We achieved our goal of regaining product leadership across our product line and of becoming leaner over all.”

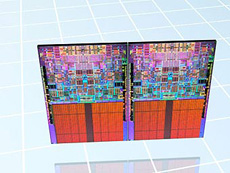

From a competitive perspective, Intel is widely perceived to have regained the upper hand. In recent quarters the company has revamped its lineup of processors, including a number of new multicore processors and its first quad-core chip. Many analysts say Intel seems to be reclaiming technological leadership over Advanced Micro Devices and the company appears to have regained some of the market share it lost.

A.M.D., the No. 2 chip maker, is scheduled to report earnings on Thursday. In October, it issued a mixed report, posting its fourth quarterly loss in a row while showing signs of progress in curbing its expenses.

The company had initially set a goal of breaking even in the fourth quarter, but many investors are skeptical that it can achieve that goal for at least a few quarters. “I don’t expect A.M.D. to have any good news anytime soon,” Mr. Danely said.

Shares of A.M.D. fell 6.7 percent in extended hours after ending at $6.12 in regular trading.

Источник: The New York Yimes

Читайте также:

Представлен отечественный сервер на базе процессоров Intel последнего поколения

Intel заявила о приостановке всех деловых операций в РФ

AMD и Intel остановили поставки в Россию процессоров и видеокарт

Планы компании Intel по развитию технологий и продуктов

Завершена первая в России программа повышения квалификации по oneAPI для преподавателей вузов

Оставить свой комментарий:

Комментарии по материалу

Данный материал еще не комментировался.